Wednesday I wrote a post regarding your real estate investing goal setting for 2008. In there I referenced that most of you would be blown away if you would actually sit down and do the math on what 10 rental properties would do to change your financial life.

Wednesday I wrote a post regarding your real estate investing goal setting for 2008. In there I referenced that most of you would be blown away if you would actually sit down and do the math on what 10 rental properties would do to change your financial life.

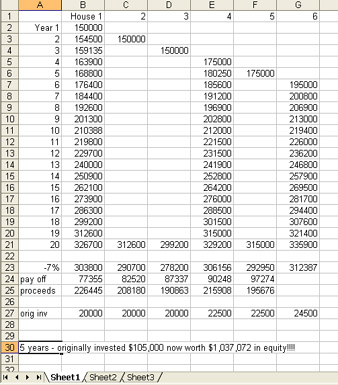

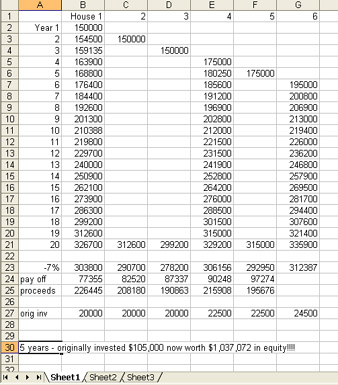

So I thought I would take a few minutes and just work through what only 5 properties would do. Now before I put up the spreadsheet let’s set some ground rules.

-

We’re saying you are 40 years old and want to retire in 20 years. You have about $25,000 a year over each of the next five years to invest in real estate.

-

You’ll be buying income property with only 10% down.

-

I’ve also calculated in as an expense $5,000 towards closing costs for each house.

-

The properties will “break even” meaning after you put the 10% down they will pay for themselves. You will NOT be receiving the benefit of Cash Flow Before Taxes.

-

I will NOT calculate depreciation which is a major benefit of owning real estate investment property.

Therefore, the only two benefits in play here are principal reduction and appreciation.

Chris! What appreciation? Haven’t you been reading the papers?

I can’t believe I have to cover this each and every time. But I will, once again. Here in Kansas City we still have pockets of appreciation. And historically, we’re at about 5% year in year out, on average. However, for you skeptics, I’m only figuring 3% appreciation for the first 5 years of each property and 4.5% after that. Remember, we’re only buying one property a year and therefore some properties might be getting 4.5% while the newer rental properties are still at 3%.

And besides, if the market really is down shouldn’t you be able to find some values out there that you could buy 3%-10% under market? Thought so.

Are you following me so far? Good. Take a look at the spreadsheet, ignoring the 6th year where I got bored and quit.

Now you can break it all down if you like. You are welcome to. But the key thing to note here are that I already took out 7% for sales costs down the road. So after 5 years of investing a total of $105,000 of your hard-earned money (and that includes some closing costs) you now have $1,037,072 in equity just waiting on you!

Yeah. But Chris. I could have taken that $105,000 and dropped it into some stocks, bonds, hedge funds, IRA’s or anything else. Right?

Of course you could. And nobody is stopping you. In fact, I might recommend taking some extra cash and doing so. But what if we had taken that whole $105,000 in year one and invested it with a solid 8% a year return and let it percolate for 20 years?

Then your investment would be worth between $489,000 and $511,000 depending on how many times a year the interest was compounded. Either way, is $511,000 better than $1,000,000?

That’s as obvious as asking a 23 year old male whether he’d rather have a date with Bea Arthur (with all due respect) or Keira Knightly.

Now, in the interest of time and space I haven’t discussed every possibility, tax implication or excluded benefit. But this should help to give you the picture. Naturally, all of this is what if’s and not expressed as a guarantee that real estate will always go up, blah, blah, blah.

Your comments, pro or con, are welcome here.

Wednesday I wrote a

Wednesday I wrote a

Many of the regular readers of BBQ Capital know that this isn’t a real estate investing site dedicated to the rehabber, flipper or big time investor. The bulk of our readers and investors own fewer than 10 investment properties. Read that again. The bulk of our investors own fewer than 10 rental properties.

Many of the regular readers of BBQ Capital know that this isn’t a real estate investing site dedicated to the rehabber, flipper or big time investor. The bulk of our readers and investors own fewer than 10 investment properties. Read that again. The bulk of our investors own fewer than 10 rental properties.

I’ve been asked to join a Kansas City real estate investing master mind for Kansas City area real estate agents. The guy heading it all up is one of the few other people in this city that I know understands the ins and outs of residential real estate investment property. So I’m excited to join on that basis.

I’ve been asked to join a Kansas City real estate investing master mind for Kansas City area real estate agents. The guy heading it all up is one of the few other people in this city that I know understands the ins and outs of residential real estate investment property. So I’m excited to join on that basis.