Spending four days in Los Angeles was quite an experience. I’ve written briefly about my trip there in previous blogs. What I haven’t told you was the curiosity that west coast real estate investors have with Kansas City. And their perceptions of Kansas City can be very eye opening. Some are rooted in fact. Some are rooted in the very fiction created on film there.

Spending four days in Los Angeles was quite an experience. I’ve written briefly about my trip there in previous blogs. What I haven’t told you was the curiosity that west coast real estate investors have with Kansas City. And their perceptions of Kansas City can be very eye opening. Some are rooted in fact. Some are rooted in the very fiction created on film there.

I have a few clients that are Los Angeles based. They own duplexes, fourplexes and single family homes. Three have visited the city. One hasn’t. And still others either grew up here or have a brother, sister or whatever that lives here. Still, we are all products of our environment.

When I lived in Suburban Maryland (DC) I thought nothing of commuting thirteen miles to work…and spending an hour and fifteen minutes in doing so. Nor was I ever surprised by self-important people or the endless amounts of wealth on display. Power and hurried-ness are very much the culture in Washington.

In LA I could feel the laid back attitude (unless behind the wheel) within an odd mixture of electricity, money and fame. I spoke with working folks who can’t afford their own homes, the real estate investors who simply cannot afford to buy local rental properties and those investors who have watched their equity positions shrink drastically over the course of the last 12-15 months.

Kansas City is more than 1/2 a continent away from those two cities. It’s another world. We are not backwards here. Nor are we the cow-town depicted in the movies. But we are a product of the heartland. A place where nothing too exciting ever happens but where hopes and dreams grow and are nourished with care. Many of our young grow up and do great things in Kansas City. Many more move on to other parts of the country to seek fame and fortune. That’s just part of life here.

Kansas City is more than 1/2 a continent away from those two cities. It’s another world. We are not backwards here. Nor are we the cow-town depicted in the movies. But we are a product of the heartland. A place where nothing too exciting ever happens but where hopes and dreams grow and are nourished with care. Many of our young grow up and do great things in Kansas City. Many more move on to other parts of the country to seek fame and fortune. That’s just part of life here.

Investing in real estate in Kansas City is different, too. As we would read about double digit appreciation all we could do was sit and wonder. And just as distant to Kansas City is the bursting real estate bubble where values fall in large percentages to the home’s value.

To be sure we get our appreciation and we get our buyer’s markets. But with jealousy and then relief we watch those on the coasts and realize what we have here. And what we have here is:

- Stable real estate growth.

- Very predictable appreciable growth patterns.

- Excellent school districts.

- One of the most sparsely populated metropolitan areas in the country.

- Excellent highway system that other cities dream of.

- A solid mixture of technology, manufacturing, industrial, service and transportation jobs. In fact, every Fortune 400 company has a branch here in the Kansas City area.

- Disposable capital that growing companies dream of.

- A good, educated work force.

- Rent ratios and vacancy rates that make a real estate investor drool.

- Low crime rates.

- A family orientated quality of life.

Many of those listed bullet points were the answers to the questions I was asked throughout my trip. Real estate investors, especially the smart ones, are after more than just the Cap Rates and Rates of Return. They want to know who their tenants will be and the likelihood that those tenants will be stable enough to buy them a property.

Many of those listed bullet points were the answers to the questions I was asked throughout my trip. Real estate investors, especially the smart ones, are after more than just the Cap Rates and Rates of Return. They want to know who their tenants will be and the likelihood that those tenants will be stable enough to buy them a property.

I think that if you’ll come to Kansas City you’ll like what you find.

Today’s Kansas City Star brings a couple of articles that drew my attention. The first being that Pulte Homes is pulling out of Kansas City.

Today’s Kansas City Star brings a couple of articles that drew my attention. The first being that Pulte Homes is pulling out of Kansas City.  NovaStar Financial had good news to report considering their circumstances. NovaStar is our subprime lender that has found itself in the national spotlight for all the wrong reasons. Watching them for the last year has been like watching a train wreck in slow motion. But shares jumped yesterday because of the subprime freeze announcement and the fact that Wachovia Bank granted them dispensation to survive till a later date.

NovaStar Financial had good news to report considering their circumstances. NovaStar is our subprime lender that has found itself in the national spotlight for all the wrong reasons. Watching them for the last year has been like watching a train wreck in slow motion. But shares jumped yesterday because of the subprime freeze announcement and the fact that Wachovia Bank granted them dispensation to survive till a later date.

Spending four days in Los Angeles was quite an experience. I’ve written briefly about my trip there in previous blogs. What I haven’t told you was the curiosity that west coast real estate investors have with Kansas City. And their perceptions of Kansas City can be very eye opening. Some are rooted in fact. Some are rooted in the very fiction created on film there.

Spending four days in Los Angeles was quite an experience. I’ve written briefly about my trip there in previous blogs. What I haven’t told you was the curiosity that west coast real estate investors have with Kansas City. And their perceptions of Kansas City can be very eye opening. Some are rooted in fact. Some are rooted in the very fiction created on film there. Kansas City is more than 1/2 a continent away from those two cities. It’s another world. We are not backwards here. Nor are we the cow-town depicted in the movies. But we are a product of the heartland. A place where nothing too exciting ever happens but where hopes and dreams grow and are nourished with care. Many of our young grow up and do great things in Kansas City. Many more move on to other parts of the country to seek fame and fortune. That’s just part of life here.

Kansas City is more than 1/2 a continent away from those two cities. It’s another world. We are not backwards here. Nor are we the cow-town depicted in the movies. But we are a product of the heartland. A place where nothing too exciting ever happens but where hopes and dreams grow and are nourished with care. Many of our young grow up and do great things in Kansas City. Many more move on to other parts of the country to seek fame and fortune. That’s just part of life here. Many of those listed bullet points were the answers to the questions I was asked throughout my trip. Real estate investors, especially the smart ones, are after more than just the Cap Rates and Rates of Return. They want to know who their tenants will be and the likelihood that those tenants will be stable enough to buy them a property.

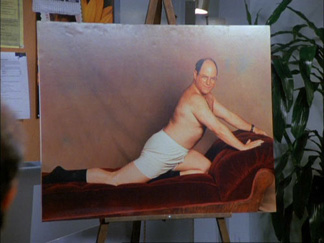

Many of those listed bullet points were the answers to the questions I was asked throughout my trip. Real estate investors, especially the smart ones, are after more than just the Cap Rates and Rates of Return. They want to know who their tenants will be and the likelihood that those tenants will be stable enough to buy them a property.  Doug and I spent 7 hours on the set of Boston Legal tonight. The experience was fantastic and made better by the fact that we were very well cared for by two ladies that my contact knew. They gave us the tour. They let us sit in with the Directors and Producers while the balcony scene was being filmed. We got to sit in on rehearsal for the restaurant scene.

Doug and I spent 7 hours on the set of Boston Legal tonight. The experience was fantastic and made better by the fact that we were very well cared for by two ladies that my contact knew. They gave us the tour. They let us sit in with the Directors and Producers while the balcony scene was being filmed. We got to sit in on rehearsal for the restaurant scene.