Buckle down and get your calculators out because today and tomorrow I will tell the story of what is and what could have been. All of this based on a real life example from an actual Olathe, Kansas investment property located about 22 miles southwest of downtown Kansas City.

Buckle down and get your calculators out because today and tomorrow I will tell the story of what is and what could have been. All of this based on a real life example from an actual Olathe, Kansas investment property located about 22 miles southwest of downtown Kansas City.

Our Investment Property: The investment property we are going to use as an example was a duplex purchased in whole in March of 1997. Built in 1988, this 2 bedroom, 2 bath duplex is located in a nice middle class neighborhood in very much a growth oriented part of Kansas City. So my guess is that appreciation here was a little stronger than it would have been in many areas of KC, though not as strong as it would have been if it had been located east of I-35. So we have a fair income property to use.

Some of the numbers include a purchase price in 1997 of $106,000. It was bought after several months on the market so we know there wasn’t a bidding war for the property. Today the property has been “split” meaning that the buyer of this property in 1997 was a fairly intelligent investor and knew that he could sell the pieces for more than the whole.

It appears as though the 1997 buyer sold the first half in April of 2000 for $83,950 and the second half in December of 2001 for $85,950. For reasons of edification, the county appraised value of each today is $96,400. Though I believe you would sell each for $105,000.

I am very familiar with this un-named neighborhood because I also own a property within it’s HOA. So all the numbers I’m using I’m very familiar with. As Hollywood would say, “based on a true story.”

Oy. Chris. You really can take a lot of time setting up situations. Couldn’t you just tell us what you have to tell us and be done with it. I have 5 other blogs I read and I only have just so much time before my boss asks me to do something…again!

Oy. Chris. You really can take a lot of time setting up situations. Couldn’t you just tell us what you have to tell us and be done with it. I have 5 other blogs I read and I only have just so much time before my boss asks me to do something…again!

Er, sorry.

What if the buyer in 1997 had the same theory of thought that so many real estate investors have that it’s better to buy a good property and hold on to it forever because each year you get closer to having the mortgage paid off and you’ll then have cash flow for life?

Well today we are going to tackle that question. Tomorrow, we’ll see where the 1997 buyer actually went. And then we’ll discuss a hypothetical on what would have happened if he had done what I recommended to him to do.

Note to all Hillary Clinton voters out there: I’m using “HIM” because that’s what my teachers (women) taught me was proper English. I fully recognize that the investor could have been a woman every bit as savvy as any man. 🙂

The Math On Our Olathe Investment Property

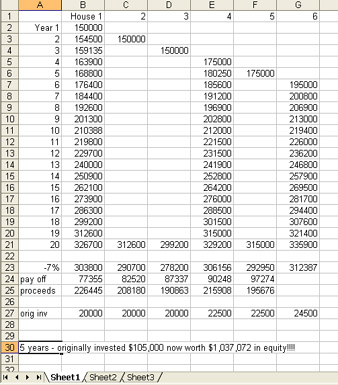

To be clear, we are calculating today’s worth if the investor had held on to this income property until today.

Purchase Price $106,000

Sales Price $210,000

Sales Costs $ 14,700

Net Appreciation $ 89,300

Original financing (let’s just say he never refinanced) was 20% down ($21,200), closing costs paid by seller (an educated guess) and 7.5% interest (probably a little high) and fully amortized over 30 years.

Loan balance at origination $84,800

Loan balance after 11 years $71,951

Principal Reduction $12,849

So let me see if I have this right. With an initial investment of $21,200 the real estate investor in question now has equity in the property of $102,149. Get your calculators out and tell me what the annual yield is. I think you’ll find it somewhere just north of 16%. Regardless, the gain in equity is nearly 4 times the initial investment…in only 11 years.

Whoa. Whoa. Whoa. Chris, once again you are forgetting a few things. What about maintenance? Like the fact that it needed new carpeting or that the walls needed painting and other such items. You simply cannot discount those factors.

Whoa. Whoa. Whoa. Chris, once again you are forgetting a few things. What about maintenance? Like the fact that it needed new carpeting or that the walls needed painting and other such items. You simply cannot discount those factors.

Oh, I agree 100%. But how to figure those in? I only have so much space, and as you said, you only have so much time before your boss comes back. Because if you are going to make me start figuring all of those items I’m also going to have to figure in Cash Flow Before Taxes as well as what Depreciation would have done to your tax situation for all of those years. (FYI: Depreciation = Smile On Your Face)

Without actually seeing the investor’s tax sheets for the past 11 years I simply cannot be accurate down to $1,000. But I can ask you to look at those numbers. Do you like what you see? It can be better. Join us tomorrow and we’ll look at another scenario based on the 1997 purchase of this Olathe duplex.

I had the pleasure yesterday of driving around some folks from the New York area. Without giving away details they are looking to purchase a duplex, live in one side and rent the other. Smart, in my opinion.

I had the pleasure yesterday of driving around some folks from the New York area. Without giving away details they are looking to purchase a duplex, live in one side and rent the other. Smart, in my opinion.  Kevin Cronin and REO Speedwagon once sang

Kevin Cronin and REO Speedwagon once sang If you have a non-performing property right now, sell. No if’s ands or buts. I don’t care if you lose money on the sale. What would you rather do? Continue to lose money every month indefinitely? If it’s a non-performing property in a less than desirable location cut your losses and run.

If you have a non-performing property right now, sell. No if’s ands or buts. I don’t care if you lose money on the sale. What would you rather do? Continue to lose money every month indefinitely? If it’s a non-performing property in a less than desirable location cut your losses and run. Kansas City real estate investing has some very exciting things going on right now for those that find themselves “in the know.” Here are a couple of things that I can make you aware of:

Kansas City real estate investing has some very exciting things going on right now for those that find themselves “in the know.” Here are a couple of things that I can make you aware of: Wednesday I wrote a

Wednesday I wrote a