Back in the beginning of March Lani Anglin-Rosales did a blog post about Famous Texas Alumni. And I got to thinking about doing one about Famous University of Kansas Alumni. But, hey, this is Kansas City so we should make note of the famous Kansas Citians regardless of which side of the state line they were from or what school they attended.

To be eligible for the list they must have been born & raised in the Kansas City area or made their bones here.

WALT DISNEY : Dude with a mouse.

DANNI BOATWRIGHT : Pretty girl. Oh, and I think she won Survivor.

HARRY TRUMAN : Midwestern sensabilities in a crazy world. I’d still vote for him.

TOM WATSON : At least for a little while he made Jack Nicholas nervous.

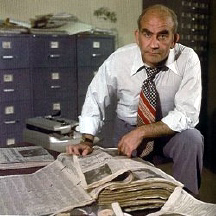

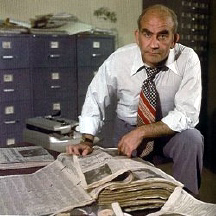

ED ASNER : Chuckles the Clown episode is the funniest thing I’ve ever seen on television.

AMELIA EARHART : Famous, ground breaking aviator.

ROBERT ALTMAN : Oscar winning director.

BUCK O’NEILL : This man, may he rest in peace, is one great American. Although he’s not in the Baseball HOF, there is an award named after him.

BIG JOE TURNER : Just sit back and listen to the blues, man.

DR. JAMES NAISMITH : Well, he actually lived and died in Lawrence, KS. But close enough. Heck, he invented my favorite sport. He had to be included!

MAURICE GREEN : World’s Fastest Man. (Well, maybe not anymore.)

COUNT BASIE : Kansas City style jazz at it’s best.

GEORGE BRETT : Kansas City’s greatest baseball player. A HOF’er who would have been a catrillionaire if he’d played in New York or Los Angeles.

(As a personal aside to George, don’t feel too badly. He seems to have done alright in his financial life.)And there you have it. A collection of Kansas City talent. Now, there are more, of course. But I’ve run out of time. And it’s not likely I have the patience to continue. Enjoy the list. Feel free to add names in the comments section!Oh, and I just have to say this because of the time of year…

….Rock Chalk!

Dear NCAA,

Dear NCAA,

It’s only twenty days until April 15 hits with a powerful punch for some of you. Have you figured your tax consequences to your 2007 activities yet? Or has your CPA?

It’s only twenty days until April 15 hits with a powerful punch for some of you. Have you figured your tax consequences to your 2007 activities yet? Or has your CPA?

What is break-even (or neutral) cash flow? Mostly a lie. Well, not really a lie so much as a fantasy. Or a projection.

What is break-even (or neutral) cash flow? Mostly a lie. Well, not really a lie so much as a fantasy. Or a projection.